Get up to speed as quickly as possible. Remember, we are still practicing HS.Playing so fast that you start to feel stress and make mistakes will notimprove technique because you are mainly practicing mistakes and acquiring badhabits. Forcing the fingers to play the same way faster is not the way toincrease speed. As demonstrated with parallel play, you need new ways thatautomatically increase speed and reduce stress. In fact, with parallel play, itis often easier to play fast than slowly. Devise hand positions and motionsthat automatically increase speed; this topic is one of the major contributionsof this book, and will be treated topic by topic later on as it is too big tobe covered here; it involves such specific skills such as thumb over method,glissando motion, relaxation, flat finger positions, arm and wrist motions,etc., and the use of “post practice improvement”. If you do not makesignificant progress in a few minutes, you are probably doing something wrong– think of something new. Students who use the intuitive method are resignedto repeating the same thing for hours with little visible improvement. Thatmentality must be avoided in order to learn faster. There are two types ofsituations you will encounter when increasing speed. One involves technicalskills you already have; you should be able to bring these up to speed inminutes. The other involves new skills; these will take longer and will bediscussed in 15. Origin and Control of Nervousness below.

Technique improves most rapidly when playing at a speed at which you can playaccurately. This is especially true when playing HT (please be patient – Ipromise we will eventually get to HT practice). Since you have more control HS,you can get away with much faster play HS than HT without increasing stress orforming bad habits. Thus it is erroneous to think that you can improve fasterby playing as fast as possible (after all, if you play twice as fast, you canpractice the same passage twice as often!). Since one major objective of HSpractice is to gain speed, the need to attain speed quickly and to practiceaccurately become contradictory. The solution is to constantly change the speedof practice; do not stay at any one speed for too long. For very difficultpassages that require skills you don’t already have, there is no alternativebut to bring the speed up in stages. For this, use speeds that are too fast asexploratory excursions to determine what needs to be changed in order to playat such speeds. Then slow down and practice those new motions.

- Username: Password.

- Experity (formerly Practice Velocity & DocuTap) is a cloud-based electronic medical records (EMR), practice management, and medical billing software solution built for on-demand care providers of all sizes and specialties including occupational medicine, pediatrics, and primary care.

- 8777 Velocity Drive Machesney Park, IL 61115. Customer/Client Support: 866-995-9863 Experity Representative: 888-357-4209 1.2.3349.

To vary the speed, first get up to some manageable “maximum speed” at which youcan play accurately. Then go faster (using parallel sets, etc., if necessary),and take note of how the playing needs to be changed (don’t worry if you arenot playing accurately at this point because you are not repeating it manytimes). Then use that motion and play at the previous “maximum accurate speed”.It should now be noticeably easier. Practice at this speed for a while, thentry slower speeds to make sure that you are completely relaxed and absolutelyaccurate. Then repeat the whole procedure. In this way, you ratchet up thespeed in manageable jumps and work on each needed skill separately. In mostcases, you should be able to play most of the new piece, at least in smallsegments, HS, at the final speed during the first sitting. In the beginning,getting up to speed at the first sitting may seem unattainable but, withpractice, every student can reach this objective surprisingly quickly.

Our team has decades of expertise, from consulting to EMR urgent care software to billing—and everything in between. Learn more about our team and culture. Practice Velocity provides clinical dispensing, medication inventory management and ePrescribing solutions.

The definition and meaning of velocity of circulation, also called the velocity of money or the velocity of circulation of money, refers to the amount of money that is circulating within the economy over a specified period – specifically, how fast it is moving. It is measured by dividing total output – or GDP (gross domestic product) – by the nation’s total money supply (amount of money available). The measure helps economists determine how healthy the economy is and whether prices will remain stable are start to rise.

Another way of looking at velocity of circulation of money, is that it is a calculation of the number of times it changes hands. It is a key ingredient of the Quantity Theory of Money.

In the United States, for example the velocity of money tells you how efficient $1 of money supply is at creating economic activity.

Velocity of circulation refers to how rapidly money passes from one holder to the next.

According to economist, the higher the velocity of money – the faster money travels – and the more transactions in which it is used, the healthier the economy is. It means that its citizens are richer and the financial system is vibrant.

According to ft.com/lexicon, velocity of circulation is:

“The average number of times a unit of money changes hands in an economy during a given period – normally measured by dividing the total amount spent (GDP) by the amount of money available (money supply).

Velocity of circulation – inflation

When velocity of circulation is very high, it can be an indication of rising inflation – prices are increasing more rapidly than normal.

The velocity of circulation will pick up when banks start increasing their lending and spending rises.

– Bank Lending: when banks feel more confident about the economy’s current and future health, they will be willing to reduce their reserves and maintain a lower **reserve ratio. They will lend more money to individuals and businesses, which will mean that customers will spend money rather than leave it sitting in bank accounts.

** Reserve ratio is the proportion of depositors’ money that a bank holds in readily-available cash.

– Consumer spending: when there is an economic recovery, consumers spend money more frequently. Rather than saving it, they will purchase more goods and services, which speeds up the velocity of circulation.

When banks raise lending and consumers spend more, aggregate demand grows, which can cause inflationary pressures. It all depends on how rapidly spending grows and how much spare capacity there is in the economy.

If factories on average are producing well below their maximum capacity, they will be able to meet the increased demand by producing more. If however, demand exceeds their maximum capacity, they will push up their prices, i.e. there will be inflation.

Whether inflation grows and becomes a problem depends in large part on how the authorities, for example the central bank, manage the economic recovery.

If the US Federal Reserve, the Bank of England, the Bank of Japan, or the European Central Bank see a possible surge in inflationary pressures, they can start tightening up monetary policy. They can raise interest rates, which will dampen lending and spending.

An effective central bank should be able to manage an economic recovery without inflation getting out of hand. It is simply a question of making sure that the velocity of circulation does not increase too rapidly.

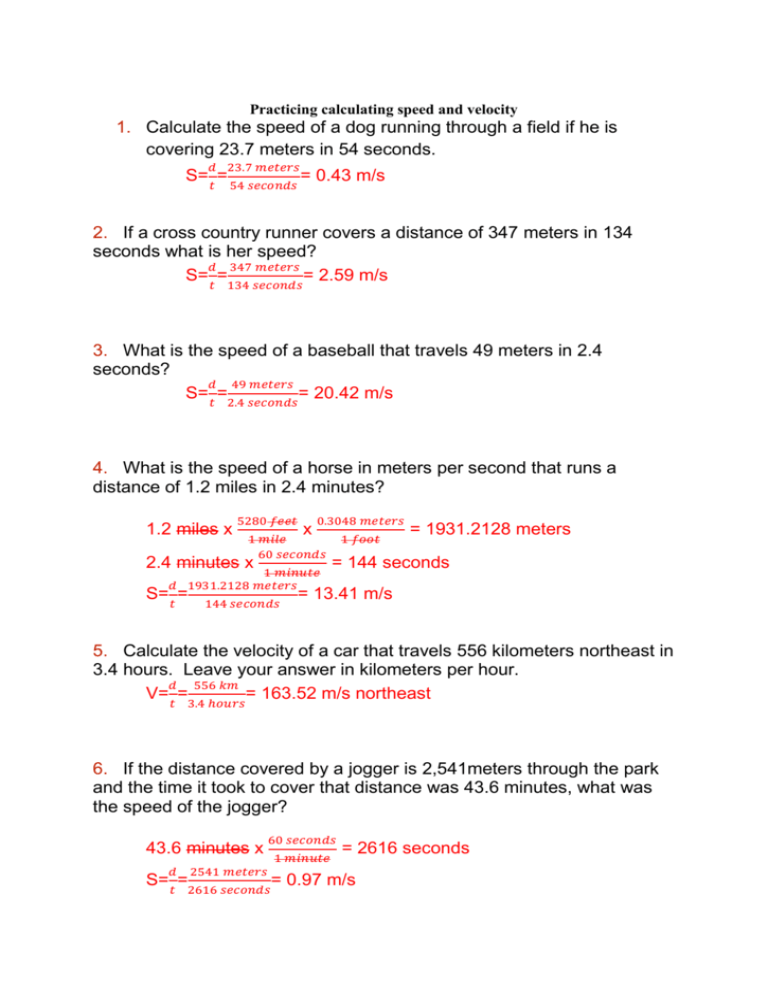

Calculating the velocity of circulation of money

The velocity of circulation refers to how often the money stock in an economy is used, over a specified time.

Calculating velocity of circulation is quite simple. It is:

Velocity of Circulation equals GDP ÷ Money Supply

Imagine a country has a total of $1,000 billion of money in its economy, and the total value of all transactions for the the year is $1,000. The velocity of circulation is 1. Total money (GDP or total production) divided by the value of all transactions.

If another country also has a total of $1,000 billion of money, but the total value of transactions is $3,000, its velocity of circulation is 3.

In basic money supply, we have these abbreviations:

MV=PT

– M = Money Supply

– VT = Velocity of Circulation. Velocity of money for all transactions in a given time frame.

– P = Price Level

– T = Transactions. The aggregate real value of transactions in a given time frame.

Practice Velocity Download

In practice, attempts to measure the velocity of circulation are indirect. Transactions velocity is computed with the following formula:

Transactions velocity formula

Practice Velocity Jobs

Thus, PT is the total nominal amount of transactions for a specific period. Values of PT and M permit calculation of VT.

Practice Velocity Docutap

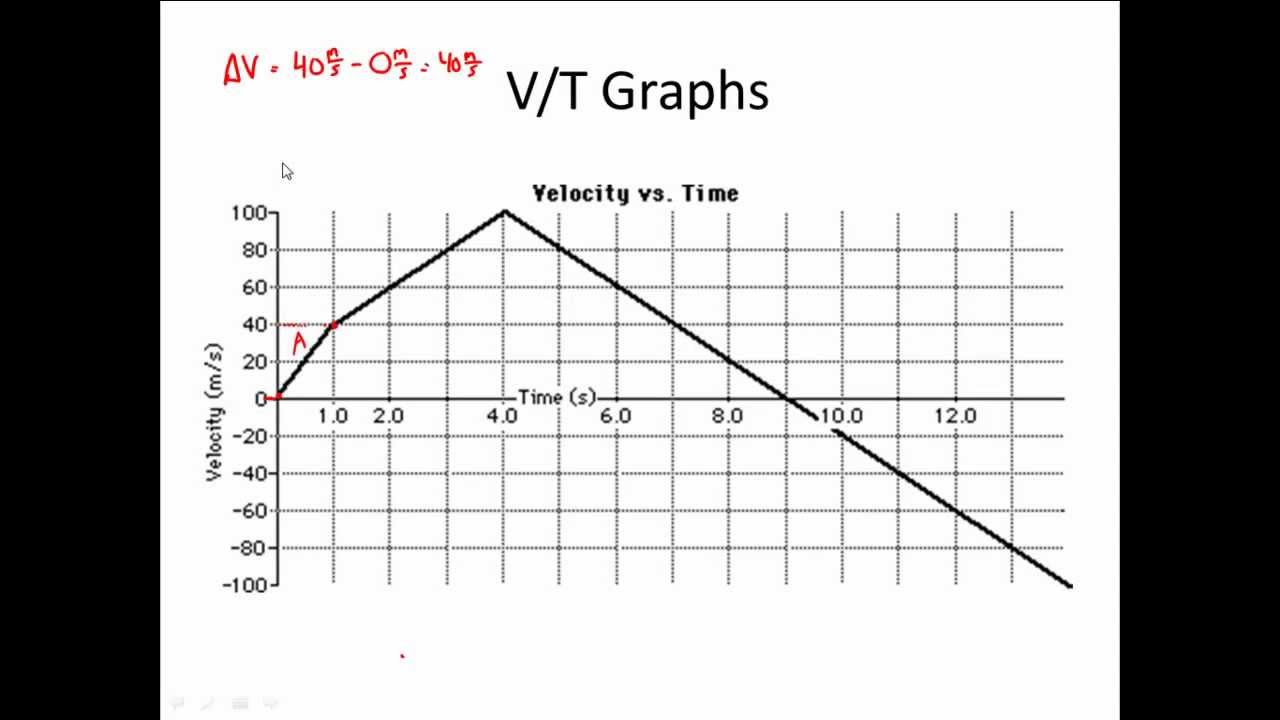

Video – Velocity of circulation and inflation

Practice Velocity Api

This Khan Academy video explains why it is the velocity of circulation, here referred to as the velocity of money, that drives prices, rather than the quantity of money.